The Technology Behind Hedge Funds

ALGORITHMIC TRADING

Hedge funds utilize algorithms to make trade decisions based on pre-set criteria, which can include anything from simple threshold crossings to complex statistical models. These algorithms help automate the trading process, reduce transaction costs, and speed up execution.

Rules-Based

The trading is based on rules set by traders, which can include things like price,

timing, and volume of the trade.

HIGH-FREQUENCY TRADING (HFT)

Some hedge funds specialize in HFT, which involves making very rapid trades to capitalize on small price discrepancies in the market. This requires extremely fast computational technologies and data connections to execute trades within fractions of a second.

Uses very fast computers and makes lots of

trades very quickly

Operates on tiny price movements to seek for small profits from each trade

Relies on speed for advantage and trades happen in milliseconds or less

Data Analytics and Big Data

Hedge funds invest in powerful analytical tools and technologies to process and analyze vast amounts of data. This includes traditional financial data, as well as alternative data sources like current news and social media sentiment. The ability to analyze and derive insights from this data can provide hedge

funds with an edge in predicting market movements.

funds with an edge in predicting market movements.

Data Collection

They gather huge amounts of data

from various sources like financial

markets, social media, economic

reports, and more.

Decision Making

They use these insights to predict

market movements, identify investment opportunities, or decide when to buy or sell assets.

Performance Improvement

Big data can be used to refine trading strategies over time, aiming to improve

returns and reduce losses.

Risk Management

Analytics helps in understanding and managing the risks associated with different investment strategies.

Analysis

Using complex algorithms and machine learning, they analyze this data to find patterns, trends, and insights that are not obvious.

Quantitative Analysis Tools

Quantitative hedge funds, or "quant"

funds, use mathematical models to

identify investment opportunities. This

requires robust statistical software and

systems capable of performing complex

mathematical calculations to forecast

market trends and valuations.

Blockchain and Cryptocurrency Technologies

Some hedge funds are exploring

investments in cryptocurrencies and

using blockchain technology for various

purposes, including improved

transaction security and efficiency.

Blockchain can also be used for creating

and managing digital assets and

executing smart contracts.

Artificial Intelligence and Machine Learning

AI and machine learning are increasingly

important in the hedge fund industry.

These technologies are used for pattern

recognition, predictive analytics, and

improving algorithmic trading strategies.

Machine learning models can adapt to

new data and market conditions over

time, potentially improving their

accuracy.

Infrastructure and Security.

As hedge funds handle sensitive financial

data and large volumes of transactions,

robust cybersecurity measures are

essential. This includes secure data

storage, encryption, and advanced

threat detection systems. Additionally,

due to the heavy reliance on data and

speed, hedge funds often invest in

high-performance computing

infrastructure and low-latency networks.

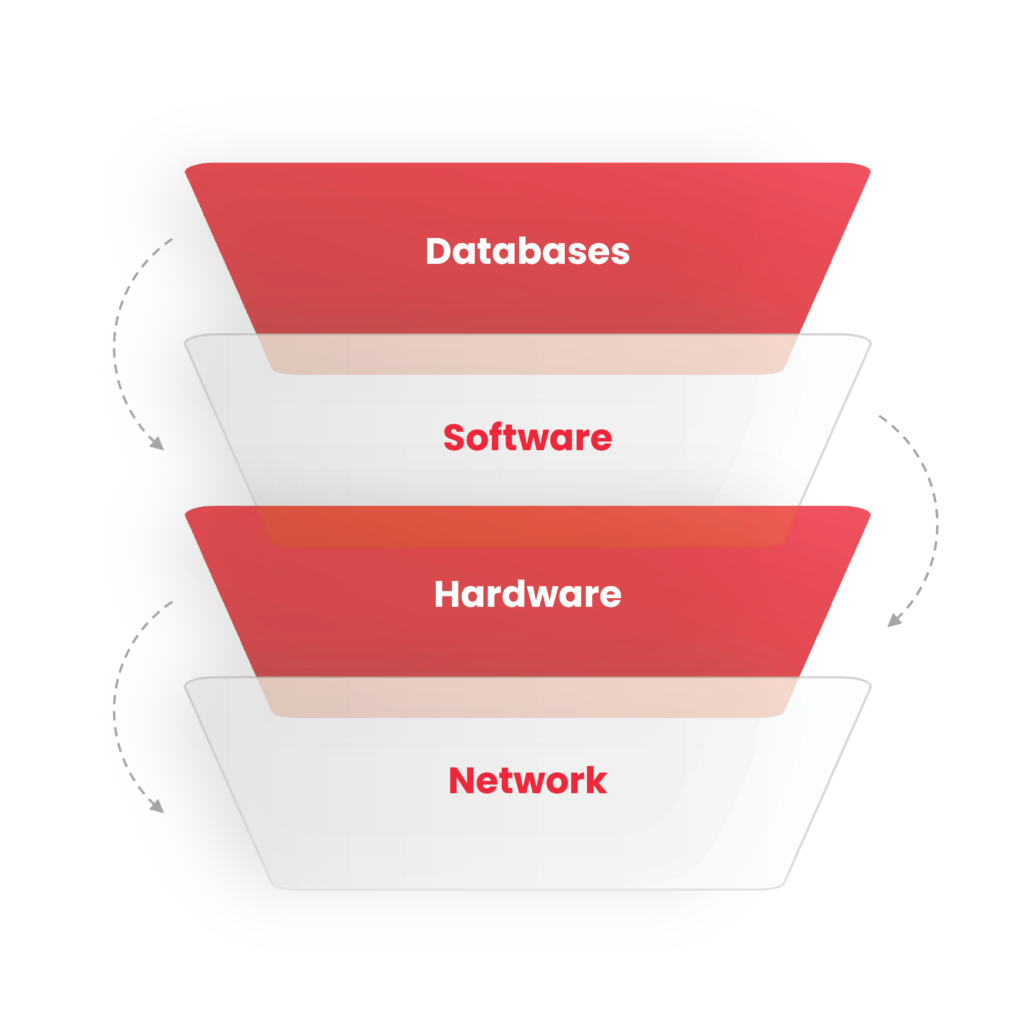

Databases

Real-time data feeds and historical databases are integrated. Technologies like in-memory databases and high-speed data analytics platforms to process and analyze data instantaneously.

Software

Employs proprietary trading algorithms designed to execute orders within milliseconds or microseconds.

Hardware

Uses high-performance servers and processors that can handle large volumes of data and computations quickly.

Network

The network and communication infrastructure that enables the rapid transmission of data between the trading systems and the markets. Effective

connectivity is crucial for maintaining the speed advantage necessary for HFT.